Why Euless, TX Is a Hotspot for DSCR Loan Rental Properties

See why Euless, Texas is emerging as an ideal location for DSCR loan rental property investments.

Veteran-owned lender, offering investors DSCR Loans in El Paso Texas for no-income-verification, hassle-free long-term financing.

Modern, long-term financing solutions

Crafted with savvy El Paso Texas investors in mind, our Long-Term DSCR Loans enable wealth building through a diverse portfolio of rental properties. By prioritizing your investment property's rental income and cash flow metrics, we simplify the loan process. As a top DSCR lender, enjoy competitive interest rates starting at 6.6%.

Fast and simple

DSCR (Debt Service Coverage Ratio) loans are a type of financing used by real estate investors that focus on the income generated by the property rather than the personal income of the borrower. Here’s a simplified explanation:

Get the financing you need to build wealth with real estate in El Paso Texas using our DSCR long-term 30-year investor loans.

Terms current as of February 22, 2026

Use our DSCR Loan Calculator to accurately evaluate the financial health of your rental property. Get a personalized term sheet instantly, and join the ranks of savvy investors making smarter financial decisions.

Calculate your loan terms below, instantly!

DSCR Loan Requirements Simplified

Securing a DSCR Loan in El Paso Texas involves a focused evaluation of your experience, liquidity, credit score, and investment property's income potential. Here's a summary of the current requirements you should know before applying for a DSCR Loan in El Paso Texas:

Designed for El Paso Texas investors

El Paso Texas's Real Estate Potential: Ideal for 30-Year Rental and Long-Term DSCR Loans

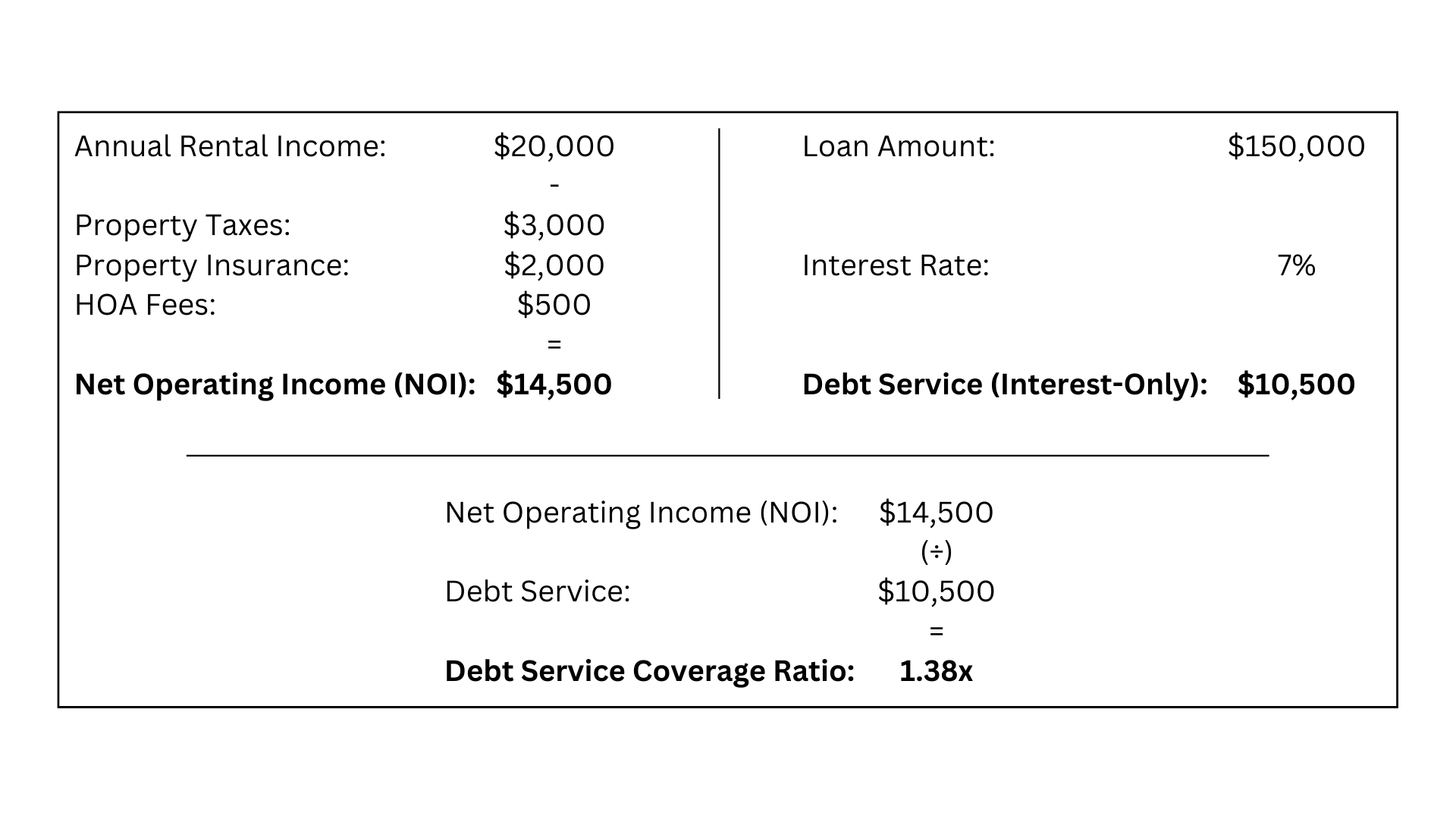

In El Paso Texas, the Debt Service Coverage Ration (DSCR) is calculated by dividing a property's rental income by it's expenses. In some cases another method could be used which involves dividing Net Operating Income (NOI) by the Debt Service.

Income: For simplicty purposes, you can think about the top line as the annual rental income for your investment property. In some cases a 90% factor might be applied.

Expenses: There are four main components of the expenses.

Here's an example so you can see exactly how DSCR is calculated. To keep things easy, we are assuming there is no principal payment, which you might expect with an interest only period. To learn more about how DSCR loans work, check out our detailed article.

Longleaf Lending is a veteran-owned, direct lending firm with a deep focus on the real estate market. Established in Texas, we bring over two decades of combined experience in real estate, hard money lending, and investment banking.

Since 2018, we have funded over 600 hard money loans, totaling more than $125 million in loan value.

Our leadership includes co-founders Pete Underwood and Matt Weidert, who bring extensive experience from real estate investment, investment banking, and military service.

We are committed to providing innovative real estate solutions, with a strong focus on integrity and professionalism as a member of the American Association of Private Lenders.

For more about our journey and the dedicated team behind Longleaf Lending, visit our full About Us page.

Market trends, case studies, investment strategies, and success stories.

See why Euless, Texas is emerging as an ideal location for DSCR loan rental property investments.

Discover the pros & cons of using a DSCR loan for Airbnb investments. Learn how to scale your short-term rental portfolio with flexible financing!

Discover what lenders prioritize for DSCR loan approvals in 2025. Learn how to boost your chances and secure funding with Longleaf Lending’s investor-frien

Ready to propel your El Paso Texas rental project forward? Our simple loan request process is designed to get you the funding you need quickly and efficiently.

Begin by filling out our short form. It's straightforward and only takes a minute. Provide us with some basic information about you and your project.

After submitting your form, you'll receive a detailed term sheet from us within 24 hours. This term sheet will outline the terms of your loan and give you the confidence to proceed with your project.

Experience fast and straightforward funding. At Longleaf Lending, you'll work directly with our team throughout the entire process, from application to funding.

Applying does not affect your credit score

Begin the funding process by completing our short online form.